- #Personal budgeting software for mac manual#

- #Personal budgeting software for mac upgrade#

- #Personal budgeting software for mac software#

#Personal budgeting software for mac software#

There's also no guarantee that the budgeting software will read the file's data accurately. However, it isn't automated, so the onus is on you to import data regularly.

#Personal budgeting software for mac manual#

This approach doesn't require you to give personal banking information to your budgeting app, and it can save a lot of time compared to manual data entry. There are several file formats floating around, but. Most banks and financial institutions let you export account data, which you can import into some budgeting software. Only you can decide which is the best fit for you. Ultimately, it's a trade-off between security and convenience.

That said, budgeting apps are quick to highlight their own extensive security measures. While these terms of service documents are complex, at the very least it seems clear that if your account is compromised because you shared your details with a budgeting app, you're potentially liable for any losses. And Westpac and St.George even name company staff, to offer just a few examples. ING includes your attorney in its instructions. The six major banks whose apps we included in our test – ANZ, CommBank ING, NAB, St George, and Westpac – all clearly state that you're not to share your account PINs and passwords with anyone.ĬommBank specifically calls out family, friends and institutions. Only you can decide which is the best fit for you

Some programs support bank-sync, but do not specify whether they use a third-party service or their own systems. Third-party protection can be beneficial, as aggregation service security specialists may be better at protecting your data against online attacks, compared to app developers. Salt Edge and Yodlee are two popular aggregation services used by many budgeting programs, which provide detailed security information on their websites. These are third-party programs that establish a secure communication channel to pull all the necessary data into your budgeting software.

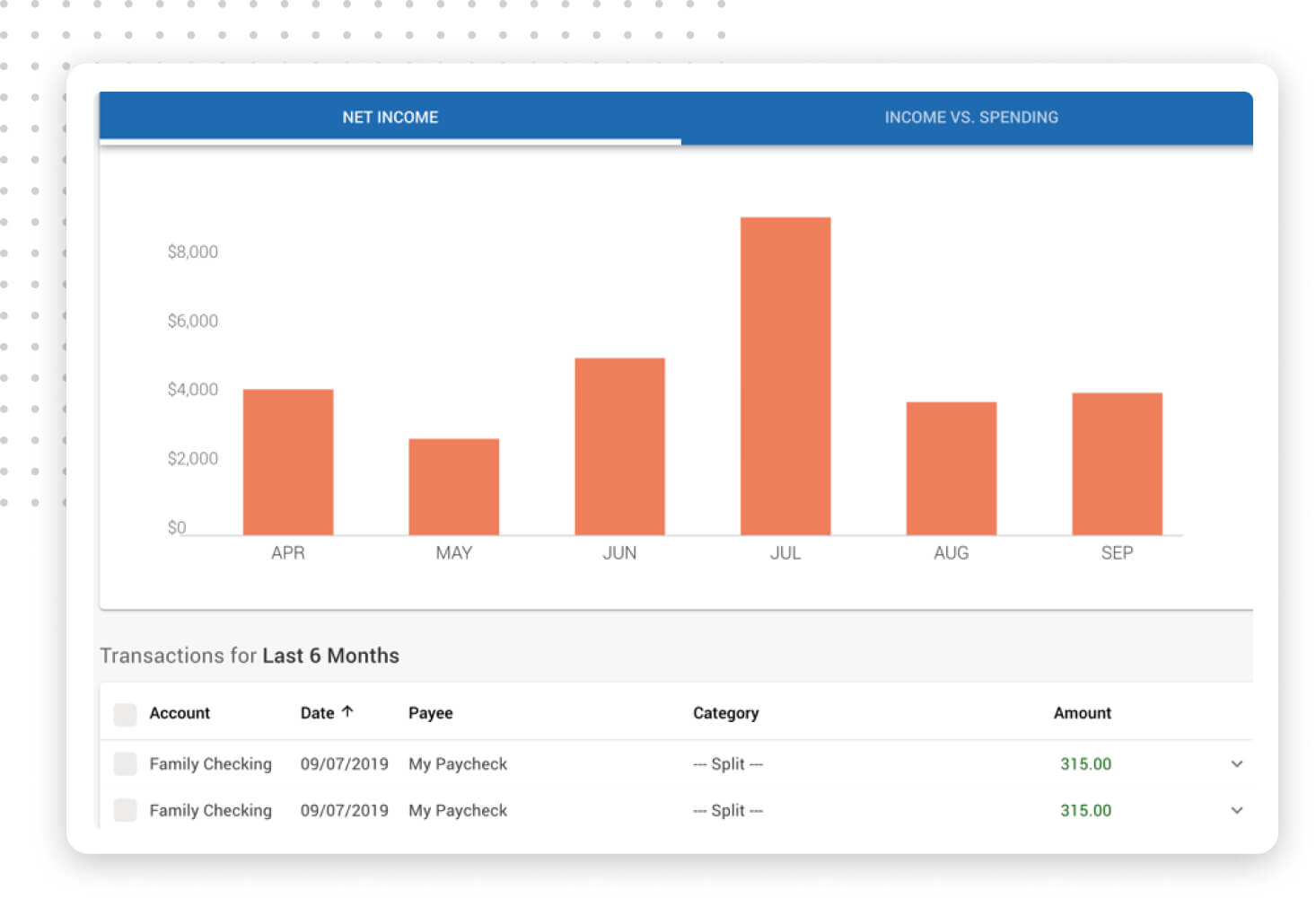

Software that can connect to banks usually uses account aggregation services. The caveat is that you must entrust a third party with your bank account details. This is the easiest approach to accurate budgeting, as the software handles most of the data entry for you. You can sync your bank account with the app so it automatically pulls in data, including income, expenses and regular bills. You can manually enter information into any available program, but apps can also automate the process to varying degrees. Bank syncing vs file import vs manual entryīudgeting software is useless without income, expense and other financial data. Not all paid apps have all these features, and some offer a few in their free version. Some budgeting apps also forecast how much money you'll spend over the next month if you keep going at the same rate.

Sticking with the one app will be easier for you in the long run.

#Personal budgeting software for mac upgrade#

Many paid apps have a free version with fewer features, so you can start free and upgrade later if you need to. See budgeting apps review Paid vs free budgeting apps

0 kommentar(er)

0 kommentar(er)